Turismo: Shifting visitor demographics

out25 luxury segment

The average hotel room rate in Macau declined for a third consecutive month in August, driven by a continued slide in prices at five-star properties, even as mid-tier hotels posted gains.

According to the latest data from the Macau Hotel Association, published by the Macau Government Tourism Office (MGTO), the city’s average hotel room rate dipped 0.4 percent year-on-year to MOP1,461.3 (US$182.1) in August.

The softness was most pronounced in the luxury segment. The five-star hotel rate fell 1.9 percent from a year earlier to MOP1,615.5, marking the 14th consecutive monthly decline since June 2024.

In contrast, the average price of four-star hotels rose 1.8 percent year-on-year to MOP1,230.9 in August, while three-star properties saw a 2 percent drop with the average nightly rate falling to MOP1,015.8.

Driven by a surge in tourist arrivals, hotel occupancy in Macau remained strong in August, averaging 96.6 percent across the three hotel categories, up 0.4 percentage points from the same month in 2024.

The monthly hotel rate report is compiled by the Macau Hotel Association, based on data from its 48 member properties, the majority of which are located within integrated resorts. These include 27 five-star, 14 four-star, and 7 three-star hotels.

https://www.macaubusiness.com/hotel-rate-falls-for-third-straight-month-as-luxury-segment-softens/

out25

Who are Macao’s three-peaters, and what do they mean for future tourism initiatives?

- Over a third of visitors from Hong Kong have come to Macao at least 3 times in the past 12 months, with those returning over 6 times outnumbering their mainland counterparts

- Innovative campaign programmes should encourage repeat visitors to explore lesser-known attractions to better distribute foot traffic more evenly, experts say

set25

Macau sees strong tourism but faces drop in per capita spending from mainland Chinese visitors

set25

Macau gaming operator Galaxy Entertainment Group has attracted a significant influx of new customers, with 40 to 50 percent of its clientele over the past 12 months being first-time visitors to its properties.

The company’s management revealed this during Goldman Sachs’ Asia Leader Conference on September 3rd in Hong Kong, highlighting the effectiveness of its strategic investment in non-gaming activities to diversify its customer base.

In a Key Takeaways note, Goldman Sachs reported that Galaxy Entertainment’s membership base has expanded substantially alongside its rated play, reflecting sustained growth in customer engagement. This success in customer acquisition comes as Galaxy continues to meet its gaming license commitments by investing heavily in entertainment offerings—particularly high-profile concerts—that are attracting younger demographics and families who may not have otherwise considered visiting Macau.

Galaxy Entertainment’s market share has also shown steady improvement, reaching approximately 21 percent in August, up from 20.4 percent in both July and the second quarter of 2025. The company attributes this growth to the ramp-up of the newly opened Capella hotel in May, an increasingly busy concert and event schedule, and normalized mass-market hold rates.

https://agbrief.com/news/macau/04/09/2025/galaxy-entertainment-attracts-40-50-new-customers-through-expanded-entertainment-offerings/?utm_source=Asia+Gaming+Brief&utm_campaign=8db14c47be-AGB%3A+%2302221+Friday%2C+05th+September%2C+2025&utm_medium=email&utm_term=0_51950b5d21-8db14c47be-%5BLIST_EMAIL_ID%5D&ct=t%28AGB%3A+%2302221+Friday%2C+05th+September%2C+2025%29&goal=0_51950b5d21-8db14c47be-%5BLIST_EMAIL_ID%5D&mc_cid=8db14c47be&mc_eid=31e20475e6

ago25

Os visitantes de Macau têm optado cada vez mais por alojamentos acessíveis, em detrimento dos hotéis de luxo. Na última década, esta categoria de alojamento mais económico foi a que maior quota de mercado conquistou. Ainda assim, os hotéis de cinco estrelas continuam a atrair mais de metade dos turistas da RAEM

https://jtm.com.mo/local/quota-de-mercado-de-alojamentos-de-baixo-custo-e-mais-cresce/

ago25

Visitors’ average stay in Macao has been shortening. That may not be such a bad thing.

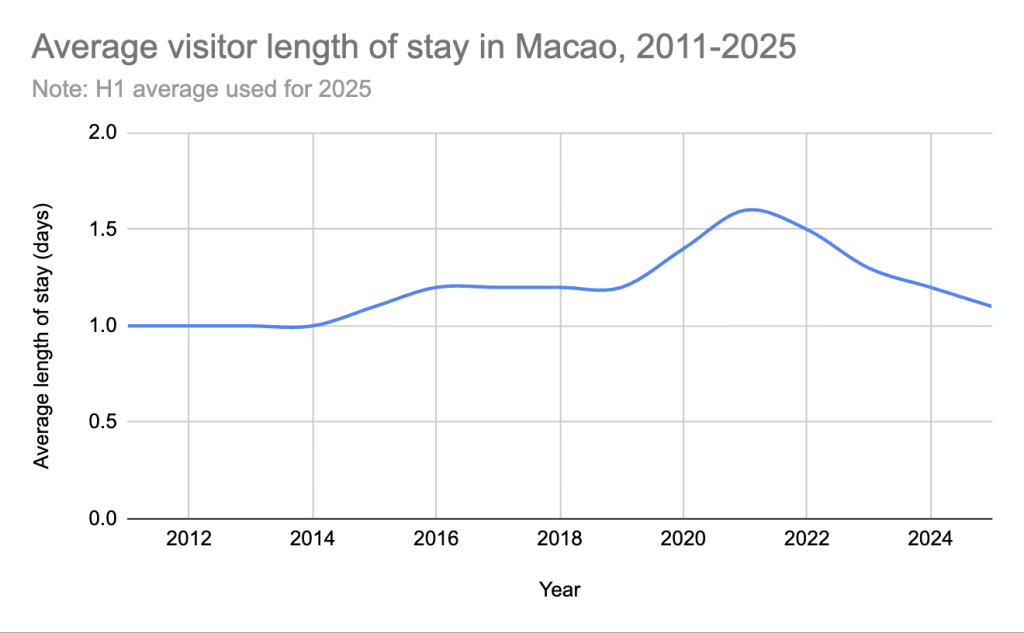

- The average length of stay for tourists in Macao has been slowly declining: from a peak of 1.6 days in 2021 to 1.1 days between January and June 2025

- Growing speed and ease of travel between Macao and other cities of the Greater Bay Area has led to a surge in the number of daytrippers

Travellers left after an average of 1.1 days in Macao during the first half of 2025 – a pattern that, if continued, would make the average length of stay this year the lowest in a decade. Is that a bad thing? Not according to researcher Ali Bavik of the University of Tourism Macao, who says it’s possible that the decrease reflects visitors’ growing preference for short but frequent trips, which generates more tourism revenue,

Macao’s volume of visitors has been growing throughout the years, with numbers increasing nearly 24 percent between 2023 and 2024. Among them, however, a building proportion have been same-day visitors, which outpaced growth in the number of overnight visitors with a 35 percent jump compared to the latter’s 12.8 percent rise.

[See more: Visitor arrivals in July are up 14.5 percent]

This uneven development means that the average length of stay for tourists has been continually shrinking: from a peak of 1.6 days in 2021 to 1.1 days between January and June 2025.

According to the Macao Government Tourism Office (MGTO), part of the problem is Macao’s image as a stopover location. “Many tourists may view Macao as a place that can be explored in a day or two, leading them to overlook the potential for a longer and more enriching stay,” they wrote in a statement to Macao News.

Caption: The average length of stay in Macao has decreased in recent years from its peak in 2021. Note: the figure for 2025 only reflects the average for the first half of the year. (Graphic – Macao News/Kayla Chan)

The MGTO says it has been combating this perception using promotional campaigns that highlight the “depth and diversity of experiences” Macao offers, and underscoring its suitability for a more extensive trip.

Types of visitors to Macao

Fluctuations in the number of overnight visitors are seasonal, according to Vikram Reddy, general manager of the Four Seasons Hotel Macao. “Major entertainment and sporting events are primary drivers,” he wrote in a statement to Macao News. Periods with major concerts tend to see higher demand, Reddy wrote, and the hotel anticipates the NBA China Games 2025 this October will similarly be a strong draw.

One reason why length of stay is an important metric is its impact on tourist spending, said Bavik. Travellers who stay for shorter periods of time may only visit major landmarks, whereas those on longer trips are likely to support a wide range of local businesses and industries, he told Macao News. “That means the financial benefit will potentially be distributed to everyone, rather than a small segment.”

But greater diversity in expenditure on longer trips doesn’t mean tourists necessarily spend more. Visitors tend to get more budget-conscious after they’ve visited a few major sites, so longer trips tend to yield diminishing returns for the local economy, Bavik said.

The decrease in average length of stay may be a reflection of shifts in the types of people visiting Macao. “Distance also influences time,” said Bavik: those travelling from farther away are more likely to stay for longer, since it would be more costly for them to revisit the city. He theorised that the increase in short-term visits could be a symptom of rising interest from proximate areas such as Zhuhai.

[See more: Non-gaming visitor spending in Macao rises 4.6 percent in the second quarter]

This falls in line with the official statistics from the MGTO: “Nearby regions [tend] to have shorter stays, while visitors from further areas tend to stay longer,” they wrote. These shorter but more regular trips lead to more tourism revenue, said Bavik.

That said, the MGTO has not let up on its efforts to increase visitors’ length of stay. The bureau says that the integration of technology and travel has made a difference, with special promotions on digital platforms having found success in encouraging visitors to prolong their stay. It also pointed to its “Macao Full of Fun – Smart Trip Planner,” launched last year, as a tool that aims to attract more overnight visitors.

[See more: Macao could be in for a record tourism performance in 2025, says academic]

At the end of the day, a location’s success as a tourist destination depends on more than just the volume of visitors. As far as tourism revenue is concerned, “It’s not just quantity, but also the quality of visitors,” said Bavik.

Also vital is a destination’s ability to keep visitors coming back for more. In that, Macao excels. “That’s why we are having short, short visits – because [visitors] know that they can come again,” Bavik said.

jul25

The unexpected resurgence of Macau gaming revenues over the past two months, which culminated in June GGR smashing consensus at 19% year-on-year growth, appears to have been supported by the performance of the high-end gaming segments, according to investment bank JP Morgan.

Analysts said in a Tuesday note that their on-the-ground checks indicate direct VIP and ultra-premium mass performed particularly well throughout the month, enough to drive June revenues back to 88% of pre-COVID levels – by far the highest recovery rate since the pandemic.

The June result also saw combined Q2 GGR come in 8% higher year-on-year and 6% higher sequentially at MOP$61 billion on the back of a similarly impressive May.

So, what drove the high-end gaming performance? According to JP Morgan’s DS Kim and Selina Li, key factors appear to have been the success of marquee concerts and events – specifically Jacky Cheung’s ongoing residency series at Galaxy Arena and three concerts by G-Dragon at the same venue early last month which helped offset the weak seasonality.

The analysts also point to improved sentiment among high-end patrons, perhaps due to positive wealth effects from stock markets, and the continued ramp-up of Capella Macau – the uber-luxury all-suite tower at Galaxy Macau that soft-opened in late April.

https://asgam.com/2025/07/01/jp-morgan-macau-ggr-surge-seemingly-sparked-by-direct-vip-ultra-premium-mass-gaming-customers/

jul25

Where will low-stakes gamblers go when Macao’s satellite casinos close?

- Some observers say low-tier gamblers could be priced out of the market entirely, while mid-tier players would likely head for core Cotai Strip casinos

- Mid-tier satellite players could be directed to core casinos’ electronic gaming areas, one expert says, which typically have lower minimum bets than dealer tables

jun25

Sands desiludida com os resultados em Macau no início do ano

Foi isso mesmo que Goldstein disse em Nova Iorque, na 41ª Conferência Anual das Decisões Estratégicas da consultora Bernstein, ao lamentar que o Grupo Sands seja o maior investidor em Macau e não esteja a ser recompensado com os retornos que ambicionava.

As palavras do líder do Sands são manchete esta manhã do jornal Tribuna de Macau. “Não tivemos um desempenho tão bom como poderíamos ter tido em termos competitivos e o nosso último trimestre foi decepcionante”, disse o CEO do grupo norte-americano. Nos primeiros três meses, os lucros da Sands baixaram 32%.

Ainda assim Goldstein também fez um ‘mea culpa’ ao dizer que a empresa precisa de ser mais agressiva num contexto marcado pelo aumento da concorrência interna e regional, bem como a ascensão do jogo online.

O gestor salientou ainda mais dois fatores que contribuem para estes resultados: a redução do consumo dos visitantes da RAEM e o fim do segmento junket.

Apesar destes resultados no início do ano, Robert Goldstein mantém-se positivo em relação à evolução do negócio em Macau.

O responsável da Sands disse estar optimista de que o território volte a movimentar entre 32 e 34 mil milhões de dólares em receitas de jogo, mas alerta que isso não acontecerá em breve. Atualmente, os casinos estão a ter receitas anuais entre os 27 e os 28 mil milhões de dólares.

https://www.plataformamedia.com/2025/06/03/sands-desiludida-com-os-resultados-em-macau-no-inicio-do-ano/

may25

The ‘she-economy’ has hit in Macao. What does it mean for tourism?

- Women are reshaping the global hospitality landscape by focusing more on culturally immersive destinations, according to Agoda, an online travel platform

- Cementing the swing is the recovery of Mainland Chinese and South Korean visitors to Macao along with gender shifts in neighboring markets like Japan and Singapore

may25

Entre Janeiro e Março, a despesa ‘per capita’ dos visitantes na RAEM desceu 13,2% em termos anuais, completando sete trimestres consecutivos com quebras homólogas. Num período em que os turistas internacionais superaram a média geral da poupança, os gastos totais dos visitantes, excluindo o jogo, baixaram 3,6% para 19,6 mil milhões de patacas, revelam dados oficiais

https://jtm.com.mo/local/gastos-de-visitantes-internacionais-sofrem-quebra-acima-da-media/

may25

‘Rapid shifts’ in visitor spending behind Macao’s shrinking GDP

- The Statistics and Census Service has released revised figures detailing the SAR’s economic performance across the first three months of the year

- It attributed a year-on-year decline in first quarter GDP to ‘rapid shifts in visitor consumption patterns, preferences and demographics’

The DSEC noted that “volatility and challenges” were having a negative impact on the global economy, in part due to “increasing uncertainties in China-US relations.” Closer to home, it acknowledged that “rapid shifts in visitor consumption patterns, preferences and demographics” had weakened spending sentiment among visitors.

“The decline in visitor expenditure has exerted pressure on the local tourism industry, contributing to fluctuations in Macao’s economic recovery in the first quarter of the year,” DSEC’s statement read.

Ending on a positive note, the statement affirmed that – barring major changes – the SAR was “unlikely to face a cyclical economic downturn and is expected to sustain its recovery momentum.

https://macaonews.org/news/business/macau-first-quarter-gdp-macao/

may25

Speaking to AGB during the G2E Asia conference held in Macau, Professor Zeng highlighted alarming trends that point to long-term challenges for the SAR’s gaming industry, suggesting that GGR may not return to pre-COVID levels in the foreseeable future.

“The government expects monthly GGR of MOP20 billion ($2.5 billion), but figures for the first four months of 2025 have consistently fallen short,” he stated.

The causes, Zeng explained, are multi-faceted. A key factor is the weakening mainland Chinese economy and the resulting decline in consumer spending.

“Even though hotel occupancy has remained stable, the average daily room rates in mainland cities dropped by around 8 percent in Q3 last year. This indicates that tourists may be traveling, but they are spending less,” he noted. “This trend is reflected in Macau as well — per capita spending and retail sales among visitors have both decreased.”

Another critical concern is the evolving structure of Macau’s visitor base. Although overall tourist numbers have nearly returned to pre-COVID levels, the composition has shifted significantly. “We are seeing an increase in elderly travelers and those under 15, while the most economically productive age groups — particularly those aged 25 to 34 and 45 to 54 — are declining,” said Zeng.

In the first quarter of 2025, visitors aged 55 and over accounted for 28 percent of total arrivals, up from just 21 percent in 2017. The number of young dependents also rose, while mid-aged groups with higher spending power either stagnated or declined. “This demographic shift is not favorable for gaming or retail consumption,” Zeng warned.

This stands in sharp contrast to Las Vegas, where the share of younger adult visitors has increased in recent years, while the proportion of senior tourists has declined — a more favorable trend for gaming revenue.

According to AGB’s analysis, when comparing 2019 to 2024, the under-15 age group saw a 6.3 percent increase in tourist numbers. Meanwhile, the economically productive 25–34 age group declined by 25.7 percent, and the 45–54 age group fell by 21.2 percent.

The elder demographic (>=65 years) experienced a notable increase of 21.4 percent during this period. This illustrates a modest rise in the youngest tourist demographic, a significant drop in key working-age segments, and a substantial growth in the number of senior visitors.

Zeng also emphasized that geographic proximity is influencing visitor behavior. “Visitors from nearby regions such as Zhuhai and Guangdong have surged due to relaxed travel rules. But the closer they live, the less they tend to spend — the novelty wears off quickly,” he said.

The academic cited survey data showing that while 60 percent of visitors from provinces beyond Guangdong would gamble in Macau, only around 23 percent of Hong Kong visitors and 40 percent of those from Guangdong would do the same.

On the issue of broader economic recovery, Zeng was cautiously realistic. “If the number of visitors continues to grow, it could partially offset declining per capita spending,” he said. “But the extent of that compensation will depend on China’s broader economic trajectory. Without recovery, spending will remain sluggish.”

Regulatory pressure and the end of the junket era

Although this is not a new issue, the scholar reiterated that the decline in GGR is also linked to increased regulatory pressure from mainland China, particularly the criminalization of cross-border gambling.

Zeng pointed to recent amendments to the criminal code that introduced a new offense — organizing cross-border gambling — which did not exist previously. “This legal shift has dismantled the traditional junket system that used to channel VIP players from the mainland to Macau. That channel has effectively closed,” he explained.

Even high-end mass market play, once seen as a potential substitute for the defunct VIP segment, has not matched previous spending levels. “According to data from Sands, high-end mass market customers have shown the most resilience, but this segment alone cannot make up for the absence of VIP revenue,” Zeng said.

Regional competition looms

Looking ahead, Zeng warned of intensifying regional competition. Japan’s integrated resort project in Osaka, set to launch operations by 2030, could attract a significant share of high-spending mainland tourists, particularly from northern provinces. “For travelers from northern China, Japan is not only closer than Macau but also offers diversified attractions such as shopping, dining, and cultural experiences,” he said.

In contrast, Macau faces physical limitations. “Most of Macau’s developable land is already in use. Future growth in hospitality and entertainment capacity will be constrained,” he noted. Some operators, such as Galaxy, have begun considering Hengqin as a spillover destination for accommodation and events.

Despite the rebound in tourist volume, Zeng cautioned against focusing solely on numbers. “Las Vegas has shown that targeting younger and more affluent segments is a more sustainable strategy,” he said. “Macau cannot rely solely on visitor numbers. Without improving the quality — particularly the spending capacity — of its tourists, the gaming industry will struggle to meet government revenue targets.”

https://agbrief.com/intel/deep-dive/12/05/2025/weak-spending-aging-tourists-weigh-on-macau-ggr-outlook-warns-expert/?utm_source=Asia+Gaming+Brief&utm_campaign=03fd454002-AGB%3A+%2302138+Tuesday%2C+13th+May%2C+2025&utm_medium=email&utm_term=0_51950b5d21-03fd454002-%5BLIST_EMAIL_ID%5D&ct=t%28AGB%3A+%2302138+Tuesday%2C+13th+May%2C+2025%29&goal=0_51950b5d21-03fd454002-%5BLIST_EMAIL_ID%5D&mc_cid=03fd454002&mc_eid=31e20475e6

Comments

Post a Comment