To direct VIP and premium mass

“Redeeming a night in a hotel room might mean players would need to bet HK$100,000 in the past, but now they might only need HK$10,000, or even less,” the officer said.

Lowering the threshold for granting such “gifts” is largely related to rising competition, they added, stating, “In the past, the turnover of a customer in a VIP room was almost equal to 100 customers in the mass market. Every VIP room had its own scope of customers, but this kind of customer has decreased nowadays.

“We have to attract more customers from the mass market in order to cover the loss [of VIPs], and giving away nights in hotel rooms is a good way to attract new customers. The competition is intense. Casinos are not only competing with other casinos in attracting customers but also in achieving their company’s sales targets.”

“We have to attract more customers from the mass market in order to cover the loss [of VIPs], and giving away nights in hotel rooms is a good way to attract new customers. The competition is intense. Casinos are not only competing with other casinos in attracting customers but also in achieving their company’s sales targets.”

The team of the interviewed employee targets quarterly rolling of MOP$7 billion (US$870 million) from the customers it brings in.

“Gaming operators tend to hire experienced employees for these positions, such as those who previously worked for Suncity,” they explained.

Chinese “premium mass” gamblers still like to spend in Macau, with 70 percent of such players in a survey sample saying they plan to make a repeat visit before March 2025, according to a “China Reality Research” poll conducted by brokerage CLSA Ltd.

Such consumer demand should help the Macau casino sector develop “healthily” over the next 12 months, said the institution in a 41-page report issued on Tuesday.

The companies haven’t yet announced their results, so it’ll be very intriguing to see how that individual split happened. What are your expectations for what they’re going to be telling us?

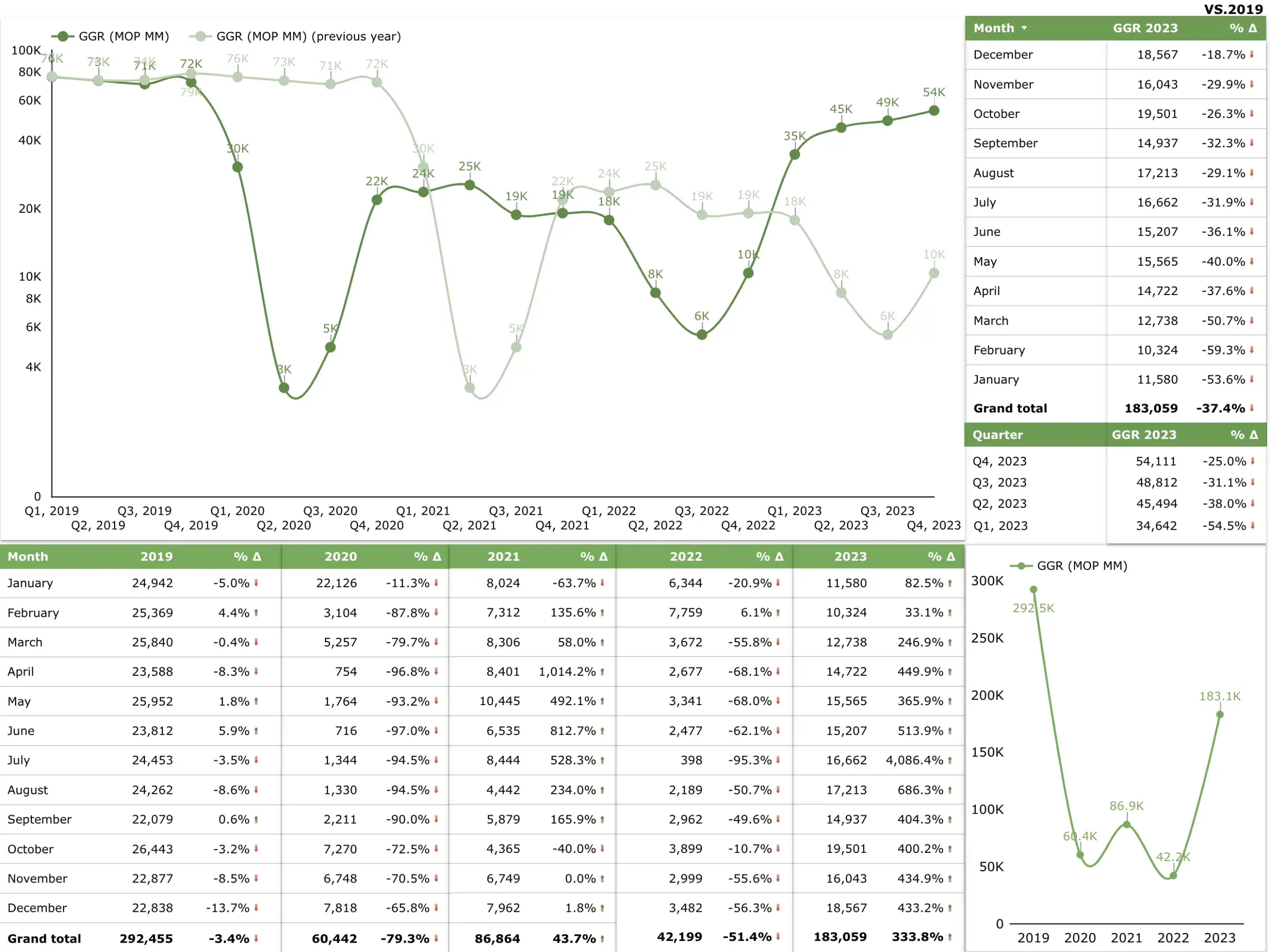

I think if we focus overall, we see the overall gross gaming revenue reached MOP183 billion in 2023, a remarkable comeback – 62 percent of the overall GGR in 2019, which is really great. But one little fact in there, that I think is really staggering, is that 87 percent of that was mass. And, that’s really showing a huge shift in what was going up, as we saw, and now we’re at a 75 percent/25 percent mix.

As receitas dos casinos no mercado de massas subiram 11% entre o segundo e terceiro trimestres deste ano, atingindo 93,3% do nível pré-pandemia, revelam dados da Direcção de Inspecção e Coordenação de Jogos. Já o jogo VIP recuou 3,2% em termos trimestrais e caiu 62% na comparação com 2019. Nos primeiros nove meses deste ano, o jogo de massas representou cerca de 75% da facturação total, reflectindo um crescimento de 21,5 pontos percentuais em relação a 2019

Sands China says it is already seeing much higher margins in its Macau business, with the trend expected to continue in the months and years ahead as visitation levels recover.

Details of the company’s margins were outlined during the company’s 3Q23 earnings call on Thursday morning (Asia time), with the market-wide shift away from VIP and towards the mass and premium mass segments showing significant benefit.

According to Patrick Dumont, President and COO of Sands China’s parent company Las Vegas Sands, group-wide EBITDA reached US$631 million in the September quarter at a 35.3% margin – up 210 basis points quarter-on-quarter.

premium mass in question and Raffles shining bright

Galaxy has upped the game. According to gaming expert Ben Lee, the new Raffles Hotel has “reached a whole new level of luxury gaming”, pushing the other five operators to innovate and compete in a new echelon they haven’t yet faced. Meanwhile, Macau’s 3Q23 results, as announced by the city’s gaming watchdog, show few surprises, as mass dominates – while raising questions over what exactly premium mass is.

Ben Lee, Managing Partner, IGamix

“This property has set a new bar for others to emulate,” notes the IGamiX Managing Partner.

The initial strong success of Wynn’s luxury-based model paved the way for Macau gaming operators to seek higher ground, a strive that Lee opines has been stagnating in recent years, as a mass market focus has taken hold.

The new player in town could be worrisome to the VIP and premium mass handle of other operators, as players are seeking the latest and greatest, already familiar with Macau’s current gaming halls and looking for the newest, most compelling and rewarding player experience.

https://agbrief.com/news/macau/18/10/2023/under-the-scope-premium-mass-in-question-and-raffles-shining-bright/?utm_source=Asia+Gaming+Brief&utm_campaign=b73d3d9a5b-EMAIL_CAMPAIGN_5_19_2022_13_42_COPY_01&utm_medium=email&utm_term=0_51950b5d21-b73d3d9a5b-69255637&ct=t(EMAIL_CAMPAIGN_5_19_2022_13_42_COPY_01)&goal=0_51950b5d21-b73d3d9a5b-69255637&mc_cid=b73d3d9a5b&mc_eid=31e20475e6

Mass-market baccarat generated nearly MOP29.77 billion (US$3.70 billion) in Macau in the third quarter of 2023, up 11.6 percent from the second quarter this year.

VIP baccarat however declined by 3.2 percent sequentially, accounting for almost MOP11.77 billion. It corresponded to a market share of 24.1 percent, according to data released on Monday by the city’s casino regulator, the Gaming Inspection and Coordination Bureau.

Mass-market gaming, including slot machines, reached MOP37.04 billion ($4.5 billion), accounting for almost 76 percent of Macau’s total GGR in the third quarter of this year, data published by the Gaming Inspection and Co-ordination Bureau (DICJ) show.

Depois de meses em queda, o mercado do jogo VIP da RAEM ainda mexe, mostrando uma recuperação sequencial de 42 por cento no segundo trimestre deste ano. Bacará continua a dominar a recuperação do mercado de massas, com resultados de outros tipos de apostas ainda muito reduzidos

jul23

Macau’s gaming regulator, the Gaming Inspection and Coordination Bureau (DICJ), reported 2Q23 revenue results on Tuesday, with mass market baccarat continuing to dominate the landscape.

According to DICJ figures, mass market baccarat revenues reached MOP$26.68 billion (US$3.32 billion) in Q2, representing 58.4% of industry-wide revenues – slightly down on the 58.9% reported in the March 2023 quarter. By comparison, mass market revenue comprised just 39.1% of all GGR in 2019.

VIP baccarat booked some improvement in 2Q23, with revenue of MOP$12.16 billion (US$1.51 billion) comprising 26.6% of GGR compared with 24.5% in Q1.

https://www.asgam.com/index.php/2023/07/18/macaus-mass-market-baccarat-responsible-for-58-4-of-all-ggr-in-2q23/

jul23

For months, after the criminal prosecution of Suncity and Tak Chun and their main directors, first in Wenzhou and other cities in Mainland China, then in Macau, casino gaming concessionaires closed VIP Rooms and several analysts sentenced that VIP gaming in Macau was dead.

I’ve repeatedly pointed out that such an approach was neither realistic nor likely.

First, because if that was the case, if the new Macau SAR policy on casino gaming wanted to eradicate VIP gaming, the Law on Credit for [Casino] Gaming (Law no. 5/2004) would have been clearly amended to remove the possibility of licenced gaming promoters / junkets granting credit for casino gaming credit. Said amendment did not take place at the time of the last tender for casino gaming concessions, when the Macau Legislative Assembly and the Macau Government amended several casino gaming laws and regulations. There is a Bill amending said Law pending in the Macau Legislative Assembly but it does not remove the possibility of licenced gaming promoters / junkets continuing to grant credit for casino gaming. The Bill imposes some restrictions (we’ll return to this subject in a coming article), but that is it. Considering that it is unlikely that the Macau legislators and members of the Government do not know what Macau casino gaming credit entails, clearly the intention was not to destroy one of the main sources of gross gaming revenue (GGR) generated, and consequently, one of the main sources of Macau Government fiscal revenue.

https://www.macaubusiness.com/opinion-apparently-vip-gaming-is-not-exactly-dead-in-macau/

feb23

Some Macau gamblers that had previously been hosted by junkets do indeed appear to be “migrating to direct VIP and premium mass,” aiding the return to positive earnings since the start of the calendar year, said a Wednesday note from Hong Kong-based analyst Andrew Lee, at Jefferies Group LLC. He was citing commentary from two United States-based casino groups that have units operating in Macau and that had reported their fourth-quarter results that day.

The final-quarter numbers were from MGM Resorts International, and its majority-owned Macau unit MGM China Holdings Ltd which runs MGM Macau and MGM Cotai; and Wynn Resorts Ltd, parent of Wynn Macau Ltd, operator of Wynn Macau, and Wynn Palace in the Cotai district.

Mr Lee observed that the fourth quarter was “not the focus” of investors, as it related to a period before mainland China and Macau relaxed their Covid-19 control rules, a change that occurred in early January.

But the analyst said the Macau market recovery was “following” the sort of strong uptick in business that had been seen in the Las Vegas, Nevada, casino market in the U.S., after it returned to pre-pandemic operating conditions in mid-2021.

DS Kim, of JP Morgan Securities (Asia Pacific) Ltd, stated in a Thursday note on MGM China, citing its management: “Volumes for both mass and direct VIP had recovered to ‘well above’ 2019 lunar new year’s, in turn allowing the company to generate a very large US$5 million per day” in earnings before interest, taxation, depreciation and amortisation (EBITDA) in January. “We believe [this] should be near its record levels,” said Mr Kim.

https://www.ggrasia.com/rejig-in-macau-market-mix-bodes-well-for-ops-analysts/

Comments

Post a Comment